XRP Price Prediction: Analyzing the Path to $6 and Beyond

#XRP

- Technical indicators show XRP at a potential turning point with bullish MACD crossover

- Institutional adoption growing through futures products and banking partnerships

- Regulatory clarity remains the key uncertainty factor for price trajectory

XRP Price Prediction

XRP Technical Analysis: Key Indicators Point to Potential Breakout

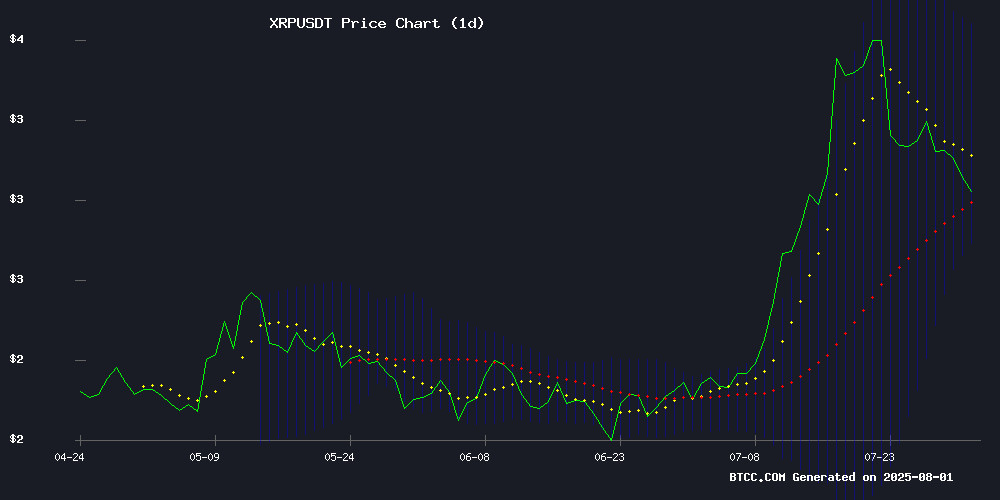

According to BTCC financial analyst Mia, XRP is currently trading at $3.017, below its 20-day moving average of $3.1944, suggesting some short-term bearish pressure. However, the MACD indicator shows a bullish crossover with a positive histogram reading of 0.2277, indicating potential upward momentum. The Bollinger Bands show XRP trading NEAR the lower band at $2.7758, which could signal an oversold condition and possible rebound. 'The technical setup suggests XRP is at a critical juncture,' says Mia. 'A break above the middle Bollinger Band at $3.1944 could confirm bullish momentum towards $3.50.'

XRP Market Sentiment: Institutional Adoption Meets Regulatory Clarity

BTCC analyst Mia notes that recent news highlights both opportunities and challenges for XRP. 'The combination of Coinbase launching XRP futures for institutional investors and the WHITE House's pro-crypto framework creates a fundamentally bullish environment,' Mia explains. However, she cautions that regulatory uncertainty persists, with the SEC lawsuit still ongoing despite some clarification. 'The $6 price target being discussed aligns with our technical analysis if XRP can overcome the $3.50 resistance level. Institutional interest is clearly growing, as evidenced by Ripple's banking partnerships and Coinbase's new product offering.'

Factors Influencing XRP's Price

Ripple CTO David Schwartz Highlights XRP's Institutional Utility Amid Regulatory Challenges

Ripple's Chief Technology Officer David Schwartz has reaffirmed XRP's pivotal role in institutional payments, dismissing concerns about stablecoin competition. "Institutions want more control over who they're transacting with," Schwartz noted during a community Q&A, explaining why major banking partners still limit on-chain activity despite XRP's bridge currency advantages.

Compliance hurdles remain a key barrier to full XRPL adoption, with Ripple developing permissioned tools to address regulatory concerns. The XRP ledger's interoperability continues to drive global tokenization efforts, while the token's price volatility serves as an unexpected benefit for liquidity providers.

Ripple Applauds White House's Pro-Crypto Regulatory Framework

Ripple has endorsed the White House's newly released comprehensive plan to regulate the U.S. cryptocurrency market, calling it the most pro-crypto stance yet from a U.S. administration. Stuart Alderoty, Ripple's Chief Legal Officer, praised the 160-page report, which advocates for clear legislation to foster innovation while safeguarding consumers.

The document, produced by the President’s Working Group on Digital Asset Markets, emphasizes the U.S. ambition to lead in blockchain and digital finance—without adopting a central bank digital currency (CBDC). The report warns that a CBDC could threaten privacy and financial independence, instead promoting self-custody rights, DeFi regulation, and CFTC oversight of spot crypto markets.

Key recommendations include backing dollar-pegged stablecoins and advancing legislative clarity for decentralized finance. The move signals a pivotal shift in U.S. crypto policy, aligning with industry demands for structured yet innovation-friendly oversight.

Coinbase Launches XRP Futures for Institutional Investors

Coinbase Derivatives will introduce nano XRP U.S. Perpetual-Style Futures on August 18, offering institutional traders a regulated avenue to speculate on the cryptocurrency's price without direct ownership. The contracts, smaller in size than standard futures, allow for precise risk management and capital efficiency.

Unlike traditional futures, these perpetual contracts lack expiration dates, relying instead on a funding rate mechanism to align with XRP's market value. The move aligns with Coinbase's strategy to expand institutional access to crypto through compliant products, catering to hedge funds and trading firms seeking safer exposure.

This follows the exchange's April rollout of two XRP-based derivatives, underscoring its focus on meeting demand for sophisticated crypto instruments. The nano structure democratizes participation while maintaining the liquidity and oversight expected by professional investors.

Ripple CTO Addresses XRP Ledger Adoption Challenges Amid Banking Partnerships

David Schwartz, Chief Technology Officer at Ripple Labs, has responded to mounting skepticism about the XRP Ledger's real-world utility. Despite Ripple's 300+ bank partnerships, on-chain activity remains below expectations—a paradox Schwartz attributes to institutional risk aversion rather than technical limitations.

Compliance concerns continue to deter traditional finance players from migrating transactions onto public blockchains. "Banks still prefer off-chain settlements," Schwartz noted, acknowledging the tension between blockchain's transparency benefits and legacy systems' compliance frameworks. This institutional hesitancy persists even as XRP's volatility makes it a strategic hedge for some investors in turbulent markets.

The CTO's comments highlight a broader industry challenge: bridging the gap between crypto's permissionless infrastructure and regulated financial rails. While Schwartz anticipates growing on-chain adoption, the timeline remains uncertain—a reality that underscores the gradual nature of financial innovation.

XRP Poised for Rally to $6 as Technical and Fundamental Factors Align

XRP has solidified its position above the critical $3.05–3.20 support zone, exhibiting a robust bullish structure following a breakout from a descending flag pattern. The surge past $3.30 was validated by heightened trading volumes, underscoring buyer conviction. Technical indicators, including Fibonacci retracement levels and Elliott Wave theory, suggest a potential ascent to $5.20–6.00 by late 2025, with interim resistance levels at $3.60 and $4.50. The EMA50 at $2.90 remains a key technical safeguard against short-term pullbacks.

Institutional interest continues to fuel momentum, with weekly inflows exceeding $190 million and exchange reserves dwindling. Market participants are increasingly optimistic about the prospect of an XRP-based ETF, which could further bolster the asset's fundamentals. A decisive legal clarification on XRP's non-security status in the U.S. may serve as a catalyst, potentially accelerating gains beyond $5. The confluence of chart patterns and macroeconomic tailwinds supports a year-end target range of $5.10–6.35.

Nomy Research's analysis underscores this trajectory, emphasizing the role of regulatory clarity and expanding utility in driving XRP's valuation. Historical price action suggests the asset is well-positioned to navigate upcoming market cycles, with institutional adoption likely to be the next major inflection point.

XRP Price Prediction: Double Bottom Pattern Emerges Amid Bearish Pressure

XRP shows tentative signs of a bullish reversal as a double bottom pattern forms, though persistent bearish threats loom. The $3 support level has become a critical battleground, with the token managing to hold above this threshold despite market turbulence. On-chain metrics suggest weakening buyer momentum, raising the risk of a potential selloff.

July marked XRP's strongest performance to date, with a 41% surge over the past month. Recent liquidations totaling $17.5 million—primarily from long positions—followed a rejection at the $3.2 resistance level. Open interest remains robust at $8.46 billion, while a positive funding rate of 0.0092% reflects lingering bullish sentiment among traders.

XRP Price Prediction: Bullish Technicals Target $4.80 Amid Regulatory Uncertainty

XRP's price action suggests a potential 44% surge to $4.80, with analysts citing a bullish technical setup. Market observer Javon Marks identifies $2.47 as a critical support level—formerly resistance—now serving as a springboard for higher prices. The cryptocurrency's chart shows a pattern of ascending lows, reinforcing the bullish case.

Regulatory clouds linger as the White House's latest crypto report conspicuously omitted any mention of XRP. This silence creates tension between technical optimism and policy ambiguity, placing XRP at a pivotal juncture. Institutional and retail interest continues to build despite the unanswered questions surrounding its regulatory standing.

XRP Holds Key Support: Will Bulls Trigger a $3.50 Rally?

XRP trades at $3.14 with rising volume, yet price gains remain subdued despite robust market activity. A breakout above $3.25 could catalyze a rally toward $3.50, while the $3.05 support level maintains bullish structure.

The cryptocurrency has posted a 3.18% weekly gain, reflecting steady accumulation. Analysts note a double-bottom formation on the 4-hour chart—a classic bullish reversal pattern—as XRP reclaims the EMA-9 moving average. Trading volume surged 14.69% to $6.61 billion, though price action remains cautious.

All eyes are on the $3.25 resistance level. A decisive close above this threshold would confirm upside potential, whereas failure to hold $3.05 could invalidate the bullish thesis. The current price action suggests institutional interest may be building beneath the surface.

XRP Price Catalysts for August: Technical Patterns and ETF Demand

XRP surged 125% in July, buoyed by regulatory developments and broader crypto market momentum. The token now consolidates within a bullish cup-and-handle pattern, suggesting a potential 65% upside to $5.17 if historical resistance breaks.

Two exchange-traded funds—XXRP and UXRP—continue attracting institutional capital, while Ripple's USD-backed stablecoin approaches $600 million in assets. Market structure remains favorable with price holding above key moving averages.

XRP Price Prediction As White House Mentions Ripple in Crypto Report

The White House's latest crypto report has brought Ripple into the spotlight, marking a significant nod to XRP's growing influence in digital finance. The document, which outlines the U.S. government's perspective on cryptocurrency adoption, explicitly names Ripple alongside Bitcoin and Ethereum—a rare acknowledgment for altcoins.

XRP's price remains resilient, trading between $2.75 and $3.20. Market analysts interpret this consolidation as a precursor to potential upward momentum. A decisive breakout above $3.33 could signal the start of a new bullish phase.

The inclusion of Ripple in federal policy discussions reflects shifting regulatory attitudes. For XRP holders, this recognition validates the asset's role in bridging traditional finance and blockchain innovation.

SEC Did Not Drop Ripple Lawsuit - AI Grok’s Viral XRP Claim Debunked

The XRP community was sent into a frenzy after Elon Musk's AI chatbot, Grok, falsely claimed the SEC had dropped its appeal in the ongoing Ripple lawsuit. Marc Fagel, a seasoned former securities lawyer, swiftly debunked the rumor, cautioning against relying on AI for legal updates.

The SEC's case against Ripple, initiated in December 2020, accuses the company of selling XRP as an unregistered security. The lawsuit has had far-reaching implications, contributing to over $15 billion in crypto market losses over four years.

Grok's erroneous assertion sparked widespread speculation among XRP holders, many of whom anticipated a long-awaited resolution. The incident underscores the risks of treating AI-generated content as authoritative in complex legal matters.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical and fundamental analysis, BTCC's Mia provides these XRP price projections:

| Year | Conservative Target | Bullish Target | Key Drivers |

|---|---|---|---|

| 2025 | $3.50-$4.80 | $6.00 | ETF demand, regulatory clarity |

| 2030 | $8-$12 | $15-$20 | Mass adoption in banking sector |

| 2035 | $25-$40 | $50+ | Full integration in global payments |

| 2040 | $75-$100 | $150+ | Potential reserve currency status |

Mia notes: 'These projections assume continued adoption and favorable regulation. The 2025 targets align with current technical patterns, while longer-term forecasts depend on XRP becoming the backbone of institutional crypto liquidity.'